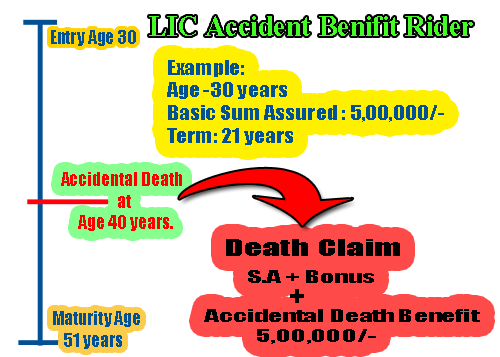

LIC Accident Benefit Rider

LIC Accident Benefit Rider (UIN No: 512B203V03) is an optional rider that covers Accidental Death only. It is an additional cover which can be opted for along with Base Policy. LIC’s Accident Benefit Rider is available on payment of additional premium. This benefit will not be available under the policy on the life of minors, during the minority of the Life Assured. However, Accident Benefit will be available from the policy anniversary following completion of age 18 years on receipt of a specific request and payment of additional premium, if found eligible for Accident Benefit as per the rules of the Corporation.

Under an in-force policy, this Rider can be opted for at any time within the policy term of the Base Plan provided the outstanding Premium Paying Term of the Base Plan, as well as the rider, is at least 5 years. The benefit cover under this rider shall be available up to the policy anniversary on which age nearer birthday of Life Assured is 70 years or till the end of Policy Term, whichever is earlier. The Rider Premium is payable by the policyholder along with the premium under Base Policy towards the cover/benefit opted under the LIC’s Accident Benefit Rider.

LIC Accident Benefit Rider Benefits:

Accident Benefit Sum Assured shall be payable

If the life assured is involved in an accident, which is defined as “a sudden, unforeseen and involuntary event caused by external, violent and visible means”, leading to death and such incident shall occur within 180 days from the date of the accident, then Accident Benefit Sum Assured shall be payable. Benefit is available up to premium paying term under the basic plan or age 70 whichever is earlier.

Maturity Benefit:

No maturity benefit is payable under this Rider.

LIC Accident Benefit Rider Premium:

Rs. 0.50 per 1000 Accident Benefit Sum Assured.

Rs. 1.00 per 1000 Accident Benefit Sum Assured, if the life assured is engaged in police duty either in any Military, Naval, or police organization and opts for this cover while engaged in police duty.

The LIC Accident Benefit Rider premium, including the taxes as applicable from time to time, is payable only along with the premium for the Base Policy and cannot be paid separately.

Conditions and restrictions:

| Sr.No. | Particulars | Eligibility Conditions |

| 1 | Minimum Entry Age | 18 years (completed) |

| 2 | Maximum Entry Age | 65 years (nearer birthday) |

| 3 | Addition of Rider under an in-force | Can be opted for by payment of additional premium at any time within the premium paying term of the Base Policy provided, the outstanding premium paying term of the Base Policy as well as Rider is at least 5 years |

| 4 | Rider Term | As per base plan or (70 – age at entry) years which ever is earlier |

| 5 | Cover Ceasing Age | 70 years (nearer birthday) |

| 6 | Minimum Sum Assured | Rs 20,000/- in multiples of Rs.5000/- |

| 7 | Maximum Sum Assured | For LIC’s Jeevan Shiromani – Rs.200 lakhs (including all other policies of LIC) For all other plans (excluding LIC’s Jeevan Shiromani) – Rs.100 lakhs. |

LIC Accident Benefit Rider Exclusions:

- after 180 days from the date of the accident

- intentional self-injury

- attempted suicide

- insanity, immorality

- whilst the Life Assured is under the influence or consumption of intoxicating liquor, narcotic or drug (unless prescribed by the doctor as a part of treatment)

- injuries resulting from taking any part in riots, civil commotion, rebellion, war (whether war be declared or not), invasion, hunting, mountaineering, steeple chasing, racing of any kind, paragliding or parachuting, taking part in adventurous sports

- Result from the Life Assured committing any criminal act with criminal intent.

- Arise from the employment of the Life Assured in the armed forces or military service. This exclusion is not applicable if the Life Assured was involved in an accident when he is not on duty or was involved in any rescue operations while combating natural calamities in our country

- arise from being engaged in police duty (which excludes administrative assignments) in any police organization other than paramilitary forces. This exclusion is not applicable where the option to cover Accidental Death and Disability Benefit arising on accident while engaged in police duty, has been chosen.

Other LIC Rider Available:

- LIC’s Accident Benefit Rider

- LIC’s Term Assurance Rider

- LIC’s Critical Illness Benefit Rider

- LIC’s Premium Waiver Benefit Rider

- LIC Linked Accidental Death Benefit Rider

- LIC’s Accidental Death & Disability Benefit Rider

Note: The above details are for information purposes only. For more authentic details about the LIC Policy please visit the official LIC website or contact your nearest LIC branch.

Pingback: LIC Linked Accidental Death Benefit Rider (UIN: 512A211V02)

Pingback: LIC Insurance Plans as on 15 April 2020 - PunitShet.com

Pingback: LIC New Critical Illness Benefit Rider (UIN: 512A212V01) - PunitShet.com

Pingback: LIC New Term Assurance Rider (UIN 512B210V01) - PunitShet.com