LIC Policy Maturity Claim in Installment

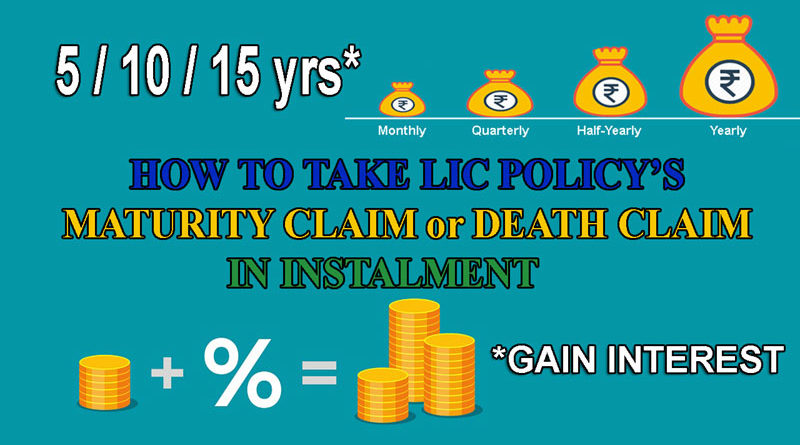

Settlement Option is an option provided by Life Insurance Corporation of India to receive LIC Maturity Claim in installment over the chosen period of 5 or 10 or 15 years instead of a lump-sum amount under an in force as well as Paid-up policy.

This option can be exercised by the Policyholder during the minority of the Life Assured or by the Life Assured aged 18 years and above, for full or part of the Maturity proceeds payable under the policy. The amount opted by the Policyholder/ Life Assured (i.e. net claim amount including the payment for deferred Survival Benefit(s), if any) can be either in absolute value or as a percentage of the total claim proceeds payable.

The installments shall be paid in advance at yearly or half-yearly or quarterly or monthly intervals, as opted for, subject to minimum installment amount for different modes of payments being as under:

| Mode of Installment payment | Minimum installment amount |

| Monthly | Rs. 5,000/- |

| Quarterly | Rs. 15,000/- |

| Half-Yearly | Rs. 25,000/- |

| Yearly | Rs. 50,000/- |

If the net claim amount is less than the required amount to provide the minimum installment amount as per the option exercised by the Life Assured, the claim proceeds shall be paid in lump sum only.

The interest rates applicable for arriving at the installment payments under Settlement Option to get the LIC Maturity Claim in installment shall be as fixed by the Corporation from time to time.

For exercising the settlement option against Maturity Benefit, the Life Assured shall be required to exercise option for payment of net claim amount in installments at least 3 months before the due date of maturity claim.

After the commencement of Installment payments under Settlement Option against Maturity Benefit:

- If a Life Assured, who has exercised Settlement Option against Maturity Benefit, desires to withdraw this option and commute the outstanding installments the same shall be allowed on receipt of a written request from the Life Assured. In such a case, the lumpsum amount, which is higher of the following shall be paid and the policy shall terminate.

- discounted value of all the future installments due; or

- (the original amount for which settlement option was exercised) less (sum of total installments already paid);

- The interest rates applicable for discounting the future installment payments shall be as fixed by the Corporation from time to time.

- After the Date of Maturity, in case of death of the Life Assured, who has exercised Settlement Option, the outstanding installments will continue to be paid to the nominee as per the option exercised by the Life Assured and no alteration whatsoever shall be allowed to be made by the nominee.

Pingback: LIC's JEEVAN LABH (Plan No: 936) - All about Life Insurance, LIC of India, LIC Policy, INCOME TAX, Mutual Fund, Technology, Automobile and Gadgets.

Pingback: LIC's New Bima Bachat (Plan No: 916) - www.punitshet.com

Pingback: LIC's SINGLE PREMIUM ENDOWMENT PLAN (Plan No: 917) - www.punitshet.com

Pingback: LIC's NEW MONEY BACK PLAN - 20 YEARS (Plan No: 920) - www.punitshet.com

Pingback: LIC's NEW MONEY BACK PLAN - 25 YEARS (Plan No: 921) - www.punitshet.com

Pingback: LIC's JEEVAN TARUN PLAN- (Plan No: 934) - www.punitshet.com

Pingback: LIC’s NEW CHILDREN’s MONEY BACK PLAN- (Plan No: 932) - www.punitshet.com

Pingback: LIC’s AADHAAR STAMBH (Plan No: 943) - www.punitshet.com

Pingback: LIC’s AADHAAR SHILA (Plan No: 943) - www.punitshet.com

Pingback: L.I.C’s New Jeevan Anand (Plan No: 915) - www.punitshet.com

Pingback: L.I.C’s New Endowment Plan (Plan No: 914) - www.punitshet.com