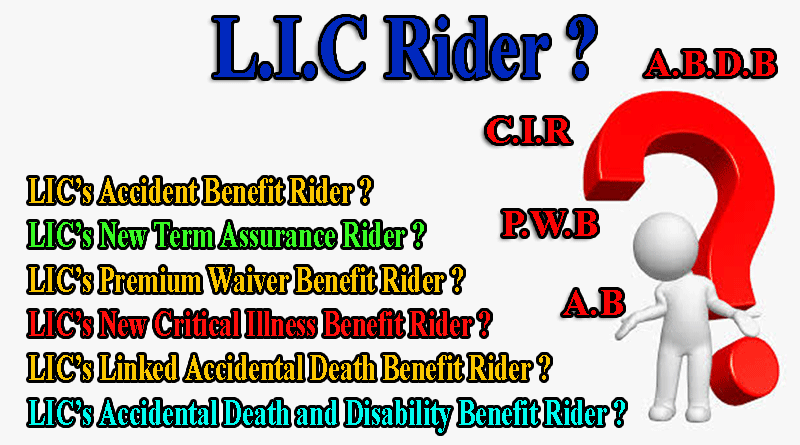

LIC Accidental Death and Disability Benefit Rider

LIC Accidental Death and Disability Benefit Rider (UIN: 512B209V02) is an additional cover which can be opted for along with Base Policy. It is available as an optional rider by payment of additional premium. Under an in-force policy, this Rider can be opted for at any time within the policy term of the Base Plan provided the outstanding Premium Paying Term of the Base Plan, as well as the rider, is at least 5 years. The benefit cover under this rider shall be available up to the policy anniversary on which age nearer birthday of Life Assured is 70 years or till the end of Policy Term, whichever is earlier. The Rider Premium is payable by the policyholder along with the premium under Base Policy towards the cover/benefit opted under the LIC’s Accidental Death and Disability Benefit Rider.

LIC Accidental Death and Disability Benefit Rider BENEFITS:

If the Life Assured is involved in an accident at any time when this Rider is in force, and such injury results in either Total and Permanent disability or death of the Life assured within 180 days of its occurrence solely, directly and independently of all other the following benefit will be payable.

(1). In case of Disability to the Life Assured:

- Disability Benefit equal to the Accident Benefit Sum Assured, divided into equal monthly installments spread over a period of 10 years, shall be paid

- Payment of future premiums, if any, shall also be waived

On death or maturity before the expiry of 10 years, during which monthly installments are to be paid, the Disability Benefit installments, which have not fallen due, will be paid in a lump sum.

(2). In case of Death of the Life Assured:

A sum equal to the Accident Benefit Sum Assured shall be payable under this Rider. However, the Rider shall have to be in force at the time of the accident (i.e. all due premiums should have been paid as on the date of accident).

(3). Maturity Benefit:

No maturity benefit is payable under this Rider.

LIC Accidental Death and Disability Benefit Rider Premium:

- The Accidental Death and Disability Benefit Rider premium, including the taxes as applicable from time to time, is payable only along with the premium for the Base Policy and cannot be paid separately.

- Once a disability claim under LIC Accidental Death and Disability Benefit Rider has been admitted, no subsequent premium towards this Rider shall be charged.

- The additional premium paid in respect of this Rider shall not be taken into account for the determination of Death Benefit of the Base Policy and in calculating the surrender value of the Base Policy

Conditions and restrictions:

| Sr.No. | Particulars | Eligibility Conditions |

| 1 | Minimum Entry Age | 18 years (completed) |

| 2 | Maximum Entry Age | 65 years (nearer birthday) |

| 3 | Addition of Rider under an in-force | Can be opted for by payment of additional premium at any time within the premium paying term of the Base Policy provided, the outstanding premium paying term of the Base Policy as well as Rider is at least 5 years |

| 4 | Rider Term | (70 – age at entry) years |

| 5 | Cover Ceasing Age | 70 years (nearer birthday) |

| 6 | Minimum Sum Assured | Rs 10,000/- |

| 7 | Maximum Sum Assured | For LIC Jeevan Shiromani – Rs.200 lakhs (including all other policies of LIC) For all other plans (excluding LIC’s Jeevan Shiromani) – Rs.100 lakhs. |

Exclusions:

- after 180 days from the date of the accident

- intentional self-injury

- attempted suicide

- insanity, immorality

- whilst the Life Assured is under the influence or consumption of intoxicating liquor, narcotic or drug (unless prescribed by a doctor as a part of treatment)

- injuries resulting from taking any part in riots, civil commotion, rebellion, war (whether war be declared or not), invasion, hunting, mountaineering, steeplechasing, racing of any kind, paragliding or parachuting, taking part in adventurous sports

- Result from the Life Assured committing any criminal act with criminal intent.

- Arise from the employment of the Life Assured in the armed forces or military service. This exclusion is not applicable if the Life Assured was involved in an accident when he is not on duty or was involved in any rescue operations while combating natural calamities in our country

- arise from being engaged in police duty (which excludes administrative assignments) in any police organization other than paramilitary forces. This exclusion is not applicable where the option to cover Accidental Death and Disability Benefit arising on accident while engaged in police duty, has been chosen

Disability Definition & Scope of Coverage:

The proximate cause of disability must be an ‘Accident’ and must be total and permanent. Accidental injuries which independently of all other causes and within 180 days from the happening of such accident result in such disability due to which life assured is unable to perform at least 4 (four) of the following Activities of Daily Living (defined below) permanently without any external help/support including the use of mechanical equipment, special devices or other aids, then such disability shall be treated as Total and Permanent. Medical Examiner authorized by the Corporation shall examine the life assured to certify the disability as Total and Permanent.

The Activities of Daily Living are:

- Dressing – the ability to put on and take off all necessary garments, artificial limbs or other surgical appliances that are medically necessary

- Washing – the ability to wash to maintain an adequate level of cleanliness and personal hygiene

- Feeding – the ability to transfer food from a plate or bowl to the mouth once the food has been prepared and made available

- Toileting – the ability to use the lavatory or otherwise manage bowel and bladder functions so as to maintain a satisfactory level of personal hygiene

- Mobility – The ability to move indoors from room to room on level surfaces at the normal place of residence

- Transferring – the ability to move from a bed to an upright chair or wheelchair and vice versa

Notwithstanding what is mentioned above, Accidental injuries which independently of all other causes and within 180 days from the happening of such accident, result in the irrecoverable

- loss of the entire sight of both eyes

- in the amputation of both hands at or above the wrists

- in the amputation of both feet at or above ankles

- in the amputation of one hand at or above the wrist and one foot at or above the ankle, shall also be deemed to constitute such disability.

Note: The above details are for information purposes only. For more authentic details about the rider please visit the official LIC website or contact your nearest LIC branch.

Pingback: LIC New Critical Illness Benefit Rider (UIN: 512A212V01) - PunitShet.com

Pingback: L.I.C Market Plus 1 (Plan No 191) - PunitShet.com

Pingback: LIC New Term Assurance Rider (UIN 512B210V01) - PunitShet.com

Pingback: LIC Accident Benefit Rider (UIN No: 512B203V03)- PunitShet.com

Pingback: LIC’s PREMIUM WAIVER BENEFIT RIDER - PunitShet.com