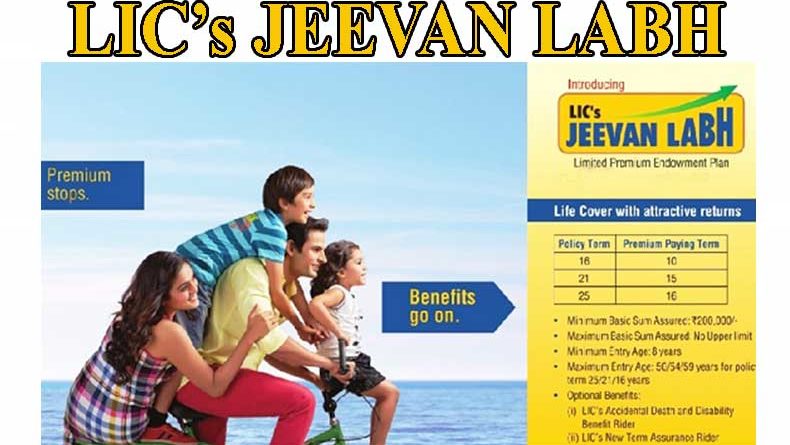

LIC JEEVAN LABH (Plan No: 936)

LIC Jeevan Labh is one of the best plans available in the basket of plans from Life Insurance Corporation of India. It offers high returns with an option to pay a premium for a limited period without the need to pay premiums for the entire term or till maturity

Policy term of 16 years, 21 years, and 25 years. Premium paying term of 10 years, 15 years & 16 years depending upon the policy term.

Unique Identification Number: 512N304V02

Launch Date: 1st February 2020

LIC Jeevan Labh Plan is Non-Linked, participating, Individual, Life Assurance Savings Plan which provides financial support for the family in case of unfortunate death of the policyholder any time before maturity and a lump sum amount at the time of maturity.

Maturity Benefit of LIC Jeevan Labh:

Sum Assured on Maturity + Simple Reversionary Bonuses + Final Additional Bonus, if any.

- Where Sum assured on maturity is equal to Basic Sum Assured.

- On Survival to the end of the policy term provided all due premiums have been paid.

- Payable in Lump Sum or as per Settlement Option exercised

Death benefit of LIC Jeevan Labh:

Sum Assured on Death + Vested Simple Reversionary Bonuses + Final Additional Bonus if any

- In case of death during the policy term provided all due premiums have been paid.

- Where “Sum Assured on Death” is defined as higher of Basic Sum Assured or 7 times of annualized premium.

- This death benefit shall not be less than 105% of all the premiums paid as on the date of death. Where premiums exclude service tax, extra premium, and rider premiums if any.

Income Tax Benefit:

- under section 80C of the Income Tax Act, premiums paid under the LIC Jeevan Labh Plan are eligible for a rebate up to the limit of Rs: 1,50,000/-

- under Section 10(10D) of Income Tax Act, The Maturity benefit received by the policyholder or the Death claim received by the Nominee under LIC Jeevan Labh Plan is entirely tax-free and no TDS is deductable.

Synopsis of LIC Jeevan Labh Plan:

| Sr. No. | Particulars | Eligibility Condition |

| 1 | Age at entry for Life assured | Minimum – 8 years completed Maximum – 59 years (nearest birthday) for Policy Term 16 years 54 years (nearest birthday) for Policy Term 21 years 50 years (nearest birthday) for Policy Term 25 years |

| 2 | Policy Term & Premium paying term | 16/10 years 21/15 years 25/16 years |

| 3 | Maximum Maturity Age | 75 years (nearer birthday) |

| 4 | Basic Sum assured (in multiples of 10,000/-) | Minimum – 2,00,000/- Maximum – Unlimited |

| 5 | Mode rebate | Yearly – 2% of tabular premium Half Yearly – 1% of tabular premium Quarterly, SSS – Nil |

| 6 | Large Sum Assured rebate (per 1000 S.A) | 2,00,000 to 4,90,000 – NIL 5,00,000 to 9,90,000 – Rs: 1.25 %o B.S.A. 10,00,000 to 14,90,000 – Rs: 1.50 %o B.S.A. 15,00,000 and above – Rs: 1.75 %o B.S.A |

| 7 | Mode of payment of premiums | Yearly Half-yearly Quarterly Monthly NACH Salary Saving Scheme |

| 8 | Grace Period | 30 days for Yearly/H-Yrly/Qtrly modes 15 days for NACH/SSS modes |

| 9 | Surrender & Policy Loan | After payment of premiums of 2 full years *conditions apply |

| 10 | Revival | Within 5 years from First Unpaid Premium & before Maturity |

| 11 | Optional Riders Available: | L.I.C’s Accidental Death & Disability Benefit Rider L.I.C’s Accident Benefit Rider L.I.C’s Term Assurance Rider L.I.C’s Critical Illness Benefit Rider L.I.C’s Premium Waiver Benefit Rider |

- For more details about Suicide Clause under LIC Policy visit http://www.punitshet.com/lic-policy-suicide-clause/

Settlement Option for Maturity Benefits:

- Settlement option can be exercised for Maturity benefits under this plan. If opted, the maturity claim amount will be paid in installment to the policy holder. To read more about Settlement Option for Maturity Benefits read: http://www.punitshet.com/lic-policy-maturity-claim-in-instalment

Option to take Death Claim Benefits in installment:

- Death Claim Benefits under this plan can be paid to the Nominee in installments provided the option has been exercised by the policyholder. To know more about How to take Death Claim in Installments read: http://www.punitshet.com/take-lic-policyholders-death-claim-amount-in-instalments

Pingback: PMVVY Extended till 31 March 2023: 7.66% interest (Yearly Pension) -

Pingback: LIC Insurance Plans as on 15 April 2020 - PunitShet.com