LIC NIVESH PLUS (PLAN 849)

LIC NIVESH PLUS, PLAN 849 is a Single Premium, Non-Participating, Unit Linked Insurance Plan, which offers insurance-cum-investment. Proposer can choose the amount of premium one desires to pay. Each premium paid shall be subject to allocation charges. Upon completion of a specified duration, guaranteed additions as a percentage of Single Premium shall be added to the unit fund under the in-force policy.

The proposer can choose the amount of Single Premium he desires to pay and has the flexibility to choose the Basic Sum Assured at the inception only.

Sum Assured Options under LIC NIVESH PLUS

- Option 1: 1.25 times of the Single Premium

- Option 2: 10 times of the Single Premium

Unique Identification Number: 512L317V01

Launch Date: 02/03/2020

Maturity Benefit:

Unit Fund Value is payable, on the Life Assured surviving the stipulated Date of Maturity.

Death benefit:

On death Before the Date of Commencement of Risk:

- An amount equal to the Unit Fund Value shall be payable.

On death After the Date of Commencement of Risk:

- An amount equal to the highest of the following shall be payable

- Basic Sum Assured reduced by Partial Withdrawals made during the two years period immediately preceding the date of death; or

- Unit Fund Value

- The Death Benefit shall be paid in a lump sum as specified above and/or in installments, as per the Settlement option exercised by the Policyholder/Life Assured.

Income Tax Benefit:

- under section 80C of the Income Tax Act, premiums paid under the LIC Nivesh Plus Plan are eligible for a rebate up to the limit of Rs: 1,50,000/- as per the prevailing Income Tax rules.

- under Section 10(10D) of Income Tax Act, The Survival benefit and Maturity benefit received by the policyholder or the Death claim received by the Nominee under LIC SIIP Plan will be exempted or taxed as per prevailing Income tax rules.

Guaranteed Addition under LIC NIVESH PLUS:

Guaranteed Additions as a percentage of Single Premium as mentioned in the table below shall be added to the Unit Fund on completion of a specific duration of policy years.

| End of Policy Year | Guaranteed Additions (as percentage of Single Premium) |

| 6 | 3% |

| 10 | 4% |

| 15 | 5% |

| 20 | 6% |

| 25 | 7% |

The allocated Guaranteed Addition shall be converted to units based on NAV of the underlying Fund type as on the date of such addition and shall be credited to the Unit Fund .

However, any Guaranteed Addition added subsequent to the date of death (in case of delay in intimation of death claim) shall be recovered from the Unit Fund.

Partial Withdrawal in LIC NIVESH PLUS:

A Policyholder can partially withdraw the units at any time after the fifth policy anniversary subject to the following:

- In the case of minors, partial withdrawals shall be allowed only after Life Assured is aged 18 years or above.

- The Partial Withdrawal may be in the form of a fixed amount or in the form of a fixed number of units.

- Maximum amount of Partial Withdrawal as a percentage of the fund during each policy year shall be as under:

| Policy Year | Percent of Unit Fund |

| 6th to 10th | 15% |

| 11th to 15th | 20% |

| 16th to 20th | 25% |

| 21st to 25th | 30% |

The above Partial withdrawal shall be allowed subject to minimum balance equal to the single premium paid in the unit fund. The partial withdrawal which would result in termination of a contract shall not be allowed. Partial withdrawal charge as specified shall be deducted from the Unit Fund Value.

If partial withdrawal has been made then for two years’ period immediately from the date of withdrawal, the Basic Sum Assured, shall be reduced to the extent of the amount of partial withdrawals made. On completion of two years’ period from the date of withdrawal the original Basic Sum Assured shall be restored.

Synopsis of LIC NIVESH PLUS Plan:

| Sr. No. | Particulars | Eligibility Condition |

| 1 | Age at entry for Life assured | Minimum – 90 days (completed) Maximum – Option 1: 70 years (nearer birthday) Option 2: 35 years (nearer birthday) |

| 2 | Policy Term | Option 1: 10 to 25 years Option 2: Age up to 25 years: 10 to 25 years Age 26 to 30 years: 10 to 20 years Age 31 to 35 years: 10 years |

| 3 | Maturity Age | Minimum: 18 years (completed) Maximum: Option 1: 85 years(nearer birthday) Option 2: 50 years(nearer birthday) |

| 4 | Premium Amount (multiple of 10,000) | Minimum: Rs 1,00,000/- Maximum: No Limit |

| 5 | Basic Sum Assured | Option 1: 1.25 times of the Single Premium Option 2: 10 times of the Single Premium |

| 6 | Rebate | NIL |

| 7 | Mode of payment of premiums | Single Premium only |

| 8 | Grace Period | Not Applicable |

| 9 | Surrender Policy Loan | Surrender /Paid Up after 5 years No Policy Loan Available |

| 10 | Revival | Not Applicable. Within 3 years from First Unpaid Premium & before Maturity if applicable. |

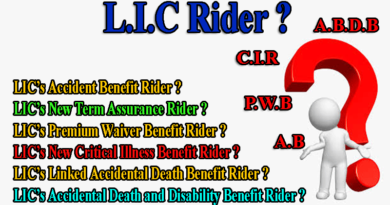

| 11 | Optional Riders Available: | L.I.C’s Linked Accidental Benefit Rider |

Date of commencement of risk:

- Applicable only if the age of Life Assured is less than 8 years

- In case the age at entry of the Life Assured is less than 8 years (last birthday), the risk under this plan will commence either one day before the completion of 2 years from the date of commencement of policy or one day before the policy anniversary coinciding with or immediately following the completion of 8 years of age, whichever is earlier.

- For those aged 8 years or more at entry, risk will commence immediately from the date of issuance of policy.

Fund Unit Allocation and Investment of Fund:

The allocated premiums will be utilized to buy units as per the fund type opted by the Policyholder out of the four fund types options available. Various types of fund options and broadly their investment patterns are as under:

| Fund Type | Investment in Government/ Government Guaranteed Securities/ Corporate Debt | Short-term investments such as money market instruments | Investment in Listed Equity Shares | Objective | Risk Profile |

| Bond Fund | Not less than 60% | Not more than 40% | Nil | To provide relatively safe and less volatile investment option mainly through accumulation of income through investment in fixed income securities. | Low risk |

| Secured Fund | Not less than 45% and Not more than 85% | Not more than 40% | Not less than 15% and Not more than 55% | To provide steady income through investment in both equities and fixed income securities. | Lower to Medium risk |

| Balanced Fund | Not less than 30% and Not more than 70% | Not more than 40% | Not less than 30% and Not more than 70% | To provide balanced income and growth through similar proportion investment in both equities and fixed income securities. | Medium risk |

| Growth Fund | Not less than 20% and Not more than 60% | Not more than 40% | Not less than 40% and Not more than 80% | To provide long term capital growth through investment primarily in equities. | High risk |

Discontinued Policy Fund:

The investment pattern of the Discontinued Policy Fund shall have the following asset mix:

- Money market instruments: 0% to 40%

- Government securities: 60% to 100%

Fund Closure:

Although the Funds are open-ended, we may close any of the existing funds with prior approval from the IRDAI. The policyholder shall be notified at least 3 months prior to the closure of the Fund. The policyholder can switch to other existing Fund options without switching charges during these 3 months. In case the policyholder does not switch during this period, Corporation shall switch the units to any other Funds with similar asset allocation and risk profile.

Charges:

1) Premium Allocation Charge:

This is the percentage of the premium appropriated towards charges from the premium received. The balance known as allocation rate constitutes that part of the premium which is utilized to purchase units for the policy.

The allocation charges are as below: 3.30%

2) Mortality Charge:

Mortality Charge is the cost of Life Insurance cover and this will be taken at the beginning of each policy month by canceling the Unit Fund Value appropriately.

This charge shall depend upon the Sum at Risk i.e. the difference between the Basic Sum Assured and the Unit Fund value as on the date of deduction of charge, after deduction of all other charges, and shall be deducted only if, the Basic Sum Assured is more than the Unit Fund Value on the date of deduction.

In case of partial withdrawals, the Basic Sum assured shall be reduced to the extent of all Partial Withdrawals made during the two years period immediately preceding the date of deduction of Mortality Charges.

Mortality charges, during a policy year, will be based on the age nearer birthday of the Life Assured as on the Policy anniversary coinciding with or immediately preceding the due date of cancellation of units and hence may increase every year on each policy anniversary. Further, this charge shall also depend on the health, occupation, and lifestyle of the Policyholder at the entry stage of the contract.

3) Accident Death Benefit Charge:

This is the charge to cover the cost of LIC’s Linked Accidental Death Benefit Rider (if opted for) levied at the beginning of each policy month by canceling an appropriate number of units out of the Unit Fund Value. A level annual charge shall be at the rate of Rs. 0.40 per thousand Accident Benefit Sum Assured per policy year. If the Life Assured is engaged in police duty in any police organization other than paramilitary forces and opted for this cover while engaged in police duty, then the level annual charge shall be at the rate of Rs 0.80 per thousand Accident Benefit Sum Assured per policy year.

4) Other Charges:

a) Fund Management Charge:

This is a charge levied as a percentage of the value of assets and shall be appropriated by adjusting the NAV. Fund Management (FMC) Charge shall be as under:

- 1.35% p.a. of Unit Fund for all the four Funds available under an in-force policy i.e. Bond Fund, Secured Fund, Balanced Fund, and Growth Fund

- 0.50% p.a. of Unit Fund for “Discontinued Policy Fund”

This is a charge levied at the time of computation of NAV, which will be done on a daily basis. The NAV thus declared will be net of FMC.

b) Switching Charge:

This is a charge levied on switching of monies from one fund to another and will be levied at the time of effecting a switch. Within a given policy year, 4 switches shall be allowed free of charge. Subsequent switches, if any, shall be subject to a Switching Charge of Rs. 100 per switch.

c) Discontinuance Charge:

This charge will be levied by canceling the appropriate number of units from the Unit Fund Value as on the date of Discontinuance of Policy. The Discontinuance Charge applicable is as under:

| Where the policy is discontinued during the policy year | Discontinuance Charges for the Policies having Single Premium up to Rs 3,00,000 | Discontinuance Charges for the Policies having Single Premium above Rs 3,00,000 |

| 1 | Lower of 2% * (SP or FV) subject to maximum of Rs. 3000/- | Lower of 1% * (SP or FV) subject to maximum of Rs. 6000/- |

| 2 | Lower of 1.5% * (SP or FV) subject to maximum of Rs. 2000/- | Lower of 0.70% * (SP or FV) subject to maximum of Rs. 5000/- |

| 3 | Lower of 1.% * (SP or FV) subject to maximum of Rs. 1500/- | Lower of 0.5% * (SP or FV) subject to maximum of Rs. 4000/- |

| 4 | Lower of 0.5% * (SP or FV) subject to maximum of Rs. 1000/- | Lower of 0.35% * (SP or FV) subject to maximum of Rs. 2000/- |

| 5 and onwards | NIL | NIL |

- SP- Single Premium

- FV – Unit Fund Value on the date of discontinuance of the policy.

“Date of discontinuance of the Policy” shall be the date on which the intimation is received from the Life Assured / Policyholder about the surrender of the policy.

d) Partial Withdrawal Charge:

This is a charge levied on the Unit Fund Value at the time of partial withdrawal of the fund and shall be a flat amount of Rs. 100/- which will be deducted by canceling appropriate number of units out of Unit Fund and the deduction shall be made on the date on which partial withdrawal takes place.

e) Tax Charge:

Tax charges, if any, will be as per prevailing Tax laws and rate of tax as applicable from time to time. Tax Charge shall be levied on all or any of the charges applicable to this plan as per the prevailing Tax laws/ notification etc. as issued by the Government of India or any other Constitutional Tax Authority of India from time to time in this regard without any reference to the policyholder.

f) Miscellaneous Charge:

This is a charge levied for an alteration within the contract, such as Grant of Accident Benefit Rider after the issue of the policy, and shall be a flat amount of Rs. 100/- which will be deducted by canceling appropriate number of units out of Unit Fund Value and the deduction shall be made on the date of alteration in the policy.

The Corporation reserves the right to accept or decline an alteration in the policy. The alteration shall take effect from the policy anniversary coincident with or following the alteration only after the same is approved by the Corporation and is specifically communicated in writing to the policyholder.

Right to revise charges & Maximum Charges deductible under LIC Nivesh Plus:

The Corporation reserves the right to revise all or any of the above charges except Mortality Charge and Accident Benefit Charge. The modification in charges will be done with prospective effect with the prior approval of IRDAI and after giving the policyholders a notice of 3 months which shall be notified through our website.

Although the charges are reviewable, they will be subject to maximum charges as declared by IRDAI from time to time. The current cap on charges is as under :

- The Fund Management Charge shall not exceed the limit specified by IRDAI

- Partial withdrawal charge shall not exceed Rs. 500/- on each withdrawal.

- Switching Charge shall not exceed Rs. 500/- per switch.

- Discontinuance charge shall not exceed the limits specified by IRDAI.

- Miscellaneous Charge shall not exceed Rs. 500/- each time when an alteration is requested.

In case the Policyholder does not agree with the revision of charges the policyholder shall have the option to withdraw the Unit Fund Value. If such revision in charges is made during the lock-in-period, withdrawal shall be allowed only after the expiry of the Lock-in-period.

Suicide Clause:-

- For more details about Suicide Clause under LIC NIVESH PLUS Policy visit http://www.punitshet.com/lic-policy-suicide-clause/

Option to take Death Claim Benefits in installment:

- Death Claim Benefits under LIC NIVESH PLUS can be paid to the Nominee in installments provided the option has been exercised by the policyholder. To know more about How to take Death Claim in Installments read: http://www.punitshet.com/take-lic-policyholders-death-claim-amount-in-instalments

Note: The above details are for information purposes only. For more authentic details about the LIC Policy please visit the official LIC website or contact your nearest LIC branch.

Good infomation about nivesh plus